Król Fondstvo:

Król Fondstvo Guides You to Crypto Learning Opportunities

Sign up now

Sign up now

Król Fondstvo serves as a bridge for individuals seeking to learn about cryptocurrency markets. It does not provide investment advice, predictions, or trading strategies. Instead, it links users to independent educational organizations that specialize in analyzing digital asset trends and market dynamics. This framework allows learners to explore programs aligned with their personal goals and interests.

Users begin by submitting basic registration information, which lets these educational providers reach out directly. Firms then share details about their courses, teaching methods, and general insights on market behavior. Król Fondstvo does not review or endorse these offerings and makes no claims about the results of participation.

By acting solely as a connector, the Site stays neutral within the education landscape. Users are responsible for assessing the relevance and quality of any content they receive. Due to the unpredictable nature of cryptocurrency markets, all learners should be aware of potential financial risks.

Understanding how financial markets operate depends on recognizing the principles that drive them. Learning materials focus on building foundational knowledge, clarifying key terms, and examining past trends rather than predicting immediate market swings. This approach develops critical thinking skills to interpret changes influenced by economic shifts and global events.

Gaining insight into financial markets involves understanding how macroeconomic trends, popular narratives, and asset price movements interrelate. While uncertainty is inherent, structured education equips learners to analyze markets more effectively. Programs generally emphasize comparing historical data, assessing risk, and developing critical thinking rather than providing specific predictions.

Identify patterns and long term trends by analyzing available data. Enrolling in educational programs does not eliminate market volatility or guarantee precise outcomes. Markets are constantly affected by global events, shifts in sentiment, and liquidity fluctuations. The value of education depends on how rigorously participants engage with materials, and risk exposure remains even with careful preparation.

Maintain your edge in ever changing markets. Król Fondstvo functions as a facilitator, connecting learners with suitable educational organizations. The Site itself does not offer lessons or instructional content. When users express interest, educators initiate outreach, helping learners access relevant programs while the Site maintains neutrality.

Registration is the first step for connecting with educational providers. This process exists solely to enable communication and does not include any teaching materials or investment advice. Users are typically asked for basic information, such as full name, email address, and phone number, to ensure messages reach the right recipients. Providing accurate details helps avoid delays and miscommunication.

Only essential contact information is required to keep the process simple and efficient. Submitting correct details allows educational providers to respond promptly and sets a clear foundation for future exchanges.

Signing up does not give access to courses, trading recommendations, or investment guidance. The Site does not review, rank, or choose educational providers. Its role is strictly to facilitate introductions. Further engagement is entirely up to the user. Given the volatility of cryptocurrency markets, careful research and professional advice are recommended to avoid potential financial losses.

Investment education helps cut through market noise to uncover the patterns underlying price movements. Sudden swings and sensational headlines can create pressure to act, but careful study shows that markets follow recurring phases. Historical trends reveal that strong rallies are often followed by corrections, highlighting the cyclical rhythm of financial systems.

Educational methods organize scattered data into logical sequences. Viewing short term volatility in the context of longer term cycles makes it easier to interpret market movements. While risk never disappears, disciplined analysis minimizes impulsive decisions. Knowledge of past downturns can foster patience when markets suddenly decline.

Patterns repeat because human behavior remains consistent. Optimism drives growth, caution signals contraction, and relief follows stabilization. Examining historical events through charts and economic data helps reveal these emotional rhythms, offering a deeper understanding of market behavior.

Markets change, yet core behavioral trends persist. Regular study, independent research, and exposure to varied perspectives build long term insight. Consulting experienced financial professionals before taking action further enhances balanced decision making.

Isolated events rarely tell the whole story. Education connects developments over time, showing how minor changes can have delayed impacts. Structured analysis turns complexity into clarity, helping investors make more thoughtful choices in shifting markets.

Investment education helps connect seemingly unrelated market signals, shifting focus from short term swings to the broader flow of market cycles, phases like accumulation, transition, and imbalance. While headlines and narratives fluctuate rapidly, core patterns tend to repeat over time.

Early indicators are often subtle rather than dramatic. Low trading volumes, narrow price ranges, and subdued sentiment can mark the groundwork for larger movements that follow.

Learning to recognize these recurring behaviors enhances context and judgment. Education doesn’t predict exact market timing; it builds perspective, allowing observation and decision making to be guided by careful analysis instead of reactive emotion.

Król Fondstvo acts as a structured communication Site, helping users and educators stay connected amid constantly changing markets.

It does not offer courses, lessons, or investment advice. Its role is purely to manage and organize interactions, ensuring inquiries are routed efficiently without shaping their content.

A methodical, tiered approach organizes incoming messages and directs them to the appropriate educators. Requests are delivered as submitted, without prioritization or ranking. During periods of high market volatility, these structured processes maintain order and clarity, demonstrating how even simple organizational frameworks can provide stability.

Markets may be dominated by short term fluctuations, but longer term trends often drive significant outcomes. The Site preserves continuity by facilitating steady, thoughtful communication. Conversations progress at a natural pace, guided entirely by the participant’s engagement, rather than external pressures or imposed urgency.

Investment education focuses on uncovering patterns beneath the surface of market activity. Instead of reacting to sudden price swings, it explores how markets progress through recurring phases such as accumulation and periods of imbalance. While headlines and stories change rapidly, the deeper structures often repeat across cycles.

The Site’s structure is defined by clearly separating access from instruction. This ensures communication stays focused and avoids overpromising outcomes. Even amid volatile markets, independent research and critical thinking remain essential. Reviewing multiple perspectives and consulting qualified financial professionals before acting helps users make thoughtful, well informed decisions.

Investment education is designed to enhance understanding, not to promise specific results. Simply accessing learning resources does not guarantee accurate predictions or profitable outcomes. Markets are shaped by human behavior, regulatory changes, and unexpected events.

The goal is to build insight rather than certainty. The same material may be interpreted differently depending on individual reasoning and perspective. Education improves judgment and awareness but cannot provide foresight.

Discussions within educational programs focus on concepts and historical patterns. They do not eliminate market uncertainty or prescribe future movements. Ultimately, results depend on the learner’s decisions and external market conditions.

Investment education aims to explain market structures and underlying dynamics rather than offer guarantees. Simply reviewing educational resources does not ensure accuracy, profits, or predictable results. Market movements are shaped by human psychology, changes in regulations, and unforeseen events.

The primary benefit of education is providing a structured framework for understanding. The same content can yield different insights depending on an individual’s perspective and analytical approach. Education enhances clarity but cannot predict the future.

Discussions within investment programs focus on concepts, historical trends, and behavioral patterns. They do not remove inherent market uncertainty or prescribe future outcomes. Results ultimately depend on personal judgment and external market developments.

Markets move independently of any single individual’s knowledge, yet education shapes how those movements are interpreted. During volatile periods, structured learning fosters calm decision making, careful risk assessment, and reconsideration of quick assumptions.

Disruptive events highlight the importance of perspective. While education cannot prevent losses or predict every downturn, it helps reduce impulsive reactions driven by uncertainty. The focus is on measured responses rather than following crowd behavior. Although foresight is never certain, disciplined awareness can mitigate unnecessary mistakes.

Investment education focuses on understanding the underlying forces that shape market behavior, including regulations, capital flows, and collective investor sentiment. These factors interact to drive markets through periods of growth, correction, and consolidation. Education helps clarify these mechanisms but does not promise certainty.

While uncertainty is always present, learning cultivates a disciplined approach. It encourages measured responses during volatile periods and promotes thoughtful analysis over impulsive reactions. Exposure to varied perspectives and ongoing study sharpens comprehension. Consulting experienced financial professionals before acting further supports sound decision making. Given the volatility of cryptocurrency markets, the potential for loss should always be considered.

Registration on the Site exists solely to facilitate communication between participants and educators. Personal data is never sold or shared publicly. By keeping data usage clearly defined, the Site ensures that interactions remain focused on educational purposes. Users should consider carefully what information they provide.

The Site does not host instructional materials directly. Instead, educators share insights and resources through personalized outreach. Topics often include market structure, principles of risk assessment, and historical market analysis.

Materials vary depending on the educator’s focus, covering both long term macro trends and short term technical developments. Reviewing multiple perspectives, performing independent research, and consulting financial professionals helps users make well informed decisions.

Data protection also relies on user discretion. Providing only necessary information and communicating clearly reduces the risk of misunderstandings. Transparent exchanges help ensure constructive and productive educational dialogue.

Understanding markets grows through careful, ongoing observation rather than knee jerk responses. Król Fondstvo helps maintain consistent access even during periods of high volatility, allowing learners to focus on study instead of being swept up by sudden swings.

Looking at longer term trends can bring perspective during turbulent periods. Stepping back often makes patterns easier to recognize and interpret.

Users provide basic contact details to allow educators to reach out. Registration does not include lessons, financial guidance, or analysis.

Education can improve awareness of how emotions influence decisions, helping users respond more thoughtfully during market fluctuations.

Król Fondstvo serves as a connector between learners and educators. It does not offer advice or endorse any perspectives. Its sole function is to facilitate communication.

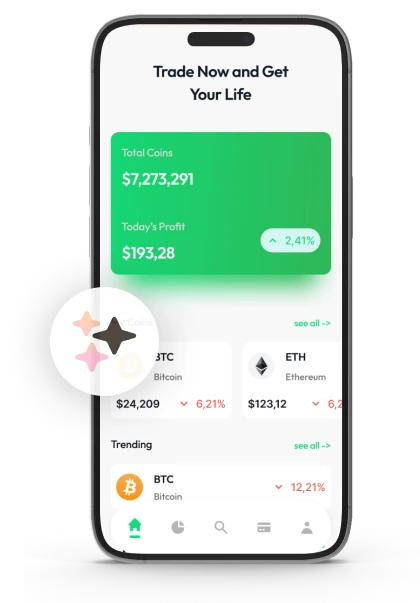

| 🤖 Initial Cost | Registration is without cost |

| 💰 Fee Policy | Zero fees applied |

| 📋 How to Register | Quick, no-hassle signup |

| 📊 Educational Scope | Offerings include Cryptocurrency, Forex, and Funds management |

| 🌎 Countries Serviced | Operates globally except in the USA |